Nvidia’s Record Sales Not Enough to Satisfy Market Expectations

Nvidia’s latest financial forecast for the third quarter has fallen short of Wall Street’s bullish predictions, despite reporting robust demand for its artificial intelligence chips.

The semiconductor company, a key player in the AI sector, announced record-breaking second-quarter revenues of $30.04 billion, reflecting a remarkable 122 percent increase compared to the previous year, and exceeding analyst expectations of $28.6 billion. However, Nvidia’s projected third-quarter sales of $32.5 billion, although surpassing consensus estimates, did not meet some analysts’ anticipations, which were as high as $37.9 billion.

Following the earnings announcement, Nvidia’s stock experienced an immediate decline, dropping 8 percent before recovering slightly to close down 5.9 percent at $118.24, which values the company at approximately $3.1 trillion.

The company’s operating income surged by 174 percent, reaching $18.64 billion, but fell short of analysts’ predictions of $18.8 billion.

Nvidia’s extensive client base includes major tech entities such as Microsoft, Google, and Meta (Facebook’s parent company), all investing heavily in AI and cloud technologies. Its chips serve over 40,000 companies across diverse sectors, including automotive, pharmaceuticals, and meteorology.

To address investor concerns over manufacturing delays of its upcoming Blackwell AI chip, Nvidia confirmed that it shipped initial samples in the second quarter and plans to ramp up production in the fourth quarter, expecting several billion dollars in revenue from Blackwell during that period.

Since its inception in 1993 in Santa Clara, California, Nvidia has undergone a significant transformation. Initially focusing on enhancing graphics for video gaming, the company has recently seen an explosion in demand as industries embrace the potential of generative AI technologies, particularly following breakthroughs such as ChatGPT.

The surge in interest surrounding AI has propelled Nvidia’s shares up nearly 680 percent over the past two years. Although it briefly claimed the title of the world’s most valuable publicly traded company in June, its current market capitalization of around $3.11 trillion ranks it below Apple at $3.45 trillion, but above Microsoft’s $3.05 trillion.

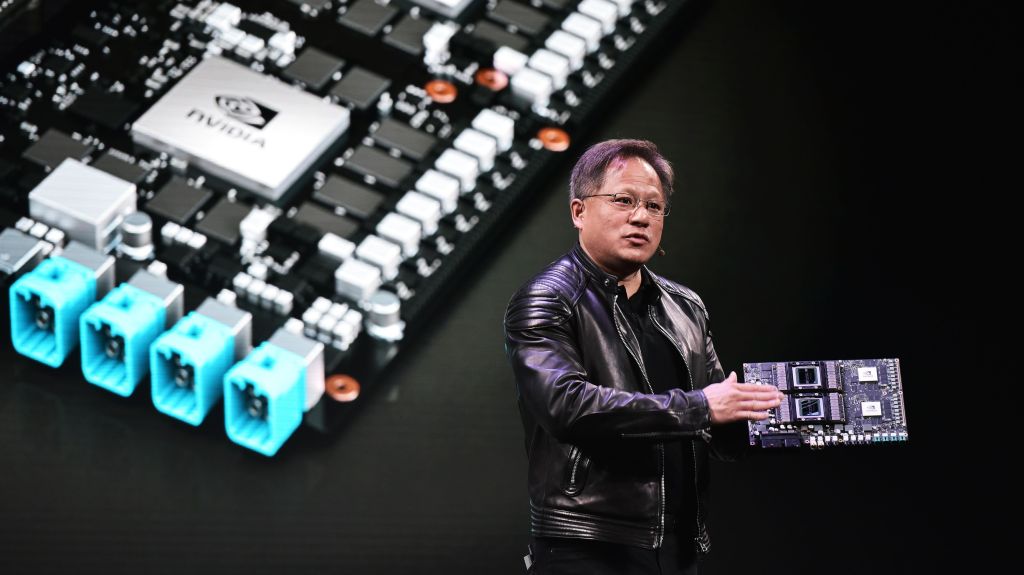

Jensen Huang, Nvidia’s founder and CEO, stated: “Nvidia achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.”

Ryan Detrick, chief market strategist at Carson Group, noted, “The size of the beat this time was much smaller than we’ve seen in prior quarters. Future guidance was raised, but not at the levels of previous earnings reports. This is a strong company still growing revenue at 122 percent, but the expectations perhaps were set a bit too high this quarter.”

Jacob Bourne, a technology analyst at Emarketer, added, “Nvidia has once again demonstrated exceptional performance, exceeding expectations with margins that rival previous record quarters, even amid economic uncertainty and concerns about the sustainability of the AI boom.”

These results emerge as OpenAI, the company behind ChatGPT and backed by Microsoft, is reportedly negotiating new funding that would elevate its valuation to over $100 billion, according to The Wall Street Journal.

Post Comment