Cuvva Wings Toward Profitable Growth: A Case Study in Innovation

After nine long years of diligently working towards profitability, Cuvva, the trailblazing short-term car insurance company, has finally achieved its financial breakthrough.

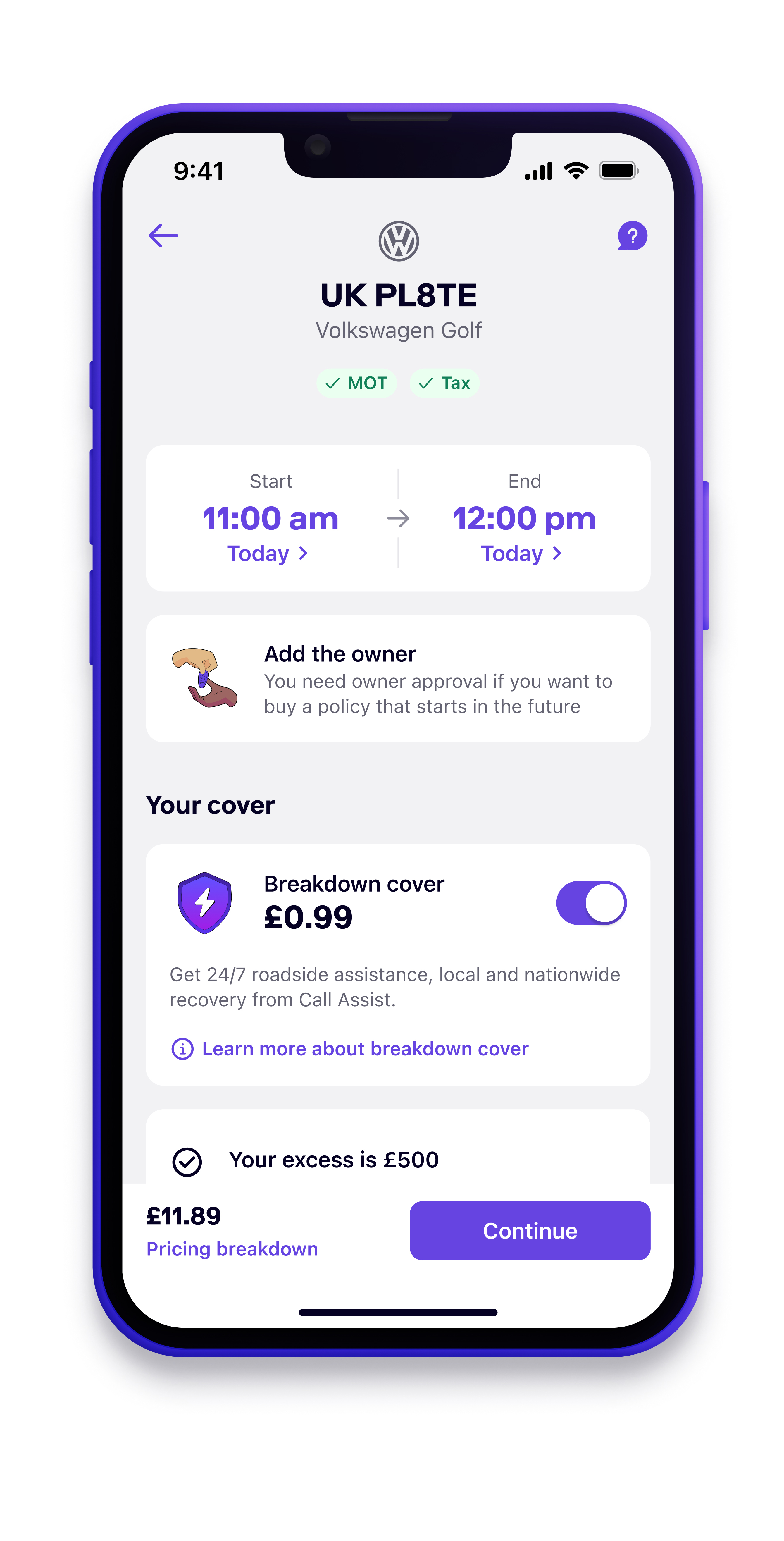

Founded by Freddy Macnamara and James Billingham, Cuvva has invested around £100 million to transition from a startup dream to a leading contender in the short-term car insurance niche. The app, famously utilized by 1.5 million users for borrowing cars, claims that a quarter of all 25-year-olds in the UK have downloaded it.

The drive towards profit, often considered the business equivalent of metamorphosis, became imperative for many venture-backed tech firms after investment flows dried up in 2022. While not all will succeed, Cuvva’s recent financial reports for 2023 indicate a revenue of £21.2 million and a profit of £3.8 million, a sharp contrast from the £6 million loss encountered in 2022.

“It’s taken nine years to get to the point where it is fun,” said Macnamara, 36. He emphasized that while Cuvva’s core product—insurance for borrowing a friend’s car for short durations—has been profitable since 2016, achieving overall profitability entailed balancing consumer demand, marketing, and product development costs.

Factors like surging reinsurance prices and vehicle repair costs post-Covid also posed challenges. Overcoming these obstacles required approximately £100 million in spending, largely funded through reinvestment and external investors, including £25 million from RTP Global and Breega, and a significant £4 million crowdfunding round in 2022 featuring 3,059 private investors.

While Macnamara diluted his ownership to onboard new investors, he maintains a 27% stake. Co-founder Billingham, who exited after five years, remains a shareholder, and employees owning shares collectively hold between 15% and 20% of the company.

Cuvva’s strategy shifted in 2022 to focus on achieving profitability rather than growth in gross written premiums. By realigning company priorities, they managed to hit their profit target just two months into the 2023 fiscal year.

This transition marked a significant change for Macnamara, who was accustomed to prioritizing growth over profitability. He described the shift as moving from spending investments to generating returns and building a substantial business.

Now that the company is cash-flow positive, Macnamara is hopeful he won’t need to seek venture capital again, finding it empowering to watch the bank balance grow each month.

A critical element of Cuvva’s profitability is their automation systems, significantly reducing customer onboarding costs. Initially building custom policy administration systems allowed them to avoid third-party fees and offer flexible policies.

Cuvva operates efficiently at scale, writing half as many policies as Admiral but with just 100 staff compared to Admiral’s 12,000. “We really have built the insurance distribution platform of the future,” Macnamara noted.

Employing consumer technology and AI, Cuvva assesses risk and automates manual tasks, such as evaluating vehicle images for pre-existing damage or fraud indicators, enhancing operational efficiency and customer satisfaction.

These innovations have bolstered customer satisfaction scores, which jumped from 85 to 92 with the introduction of an AI-powered chatbot, allowing human staff to focus on complex tasks.

Macnamara’s chart in Cuvva’s accounts reveals a dramatic turnaround from Q1 2022 to Q4 2023. He explained that after covering fixed costs, additional revenue significantly impacts profitability, a tipping point the company has successfully reached.

Despite setbacks like the temporary halt in travel insurance during Covid and withdrawing the “Subscription” product, Cuvva persevered.

Looking forward, Macnamara is preparing for the next decade with innovations like ‘car clubs’ to capitalize on growing interest in car sharing, sustainability, and technological advancements.

They recently launched software for car clubs, and within two weeks, 4,000 clubs registered. Macnamara aims to make car sharing risk-free and hassle-free for users.

Expanding into new markets can be costly, but Macnamara, now less concerned about finances, is enthusiastic. “I think making cars multiplayer is a very worthy goal for the company,” he concluded.

Post Comment